Grow Your Business with Funding For

Financing Structure

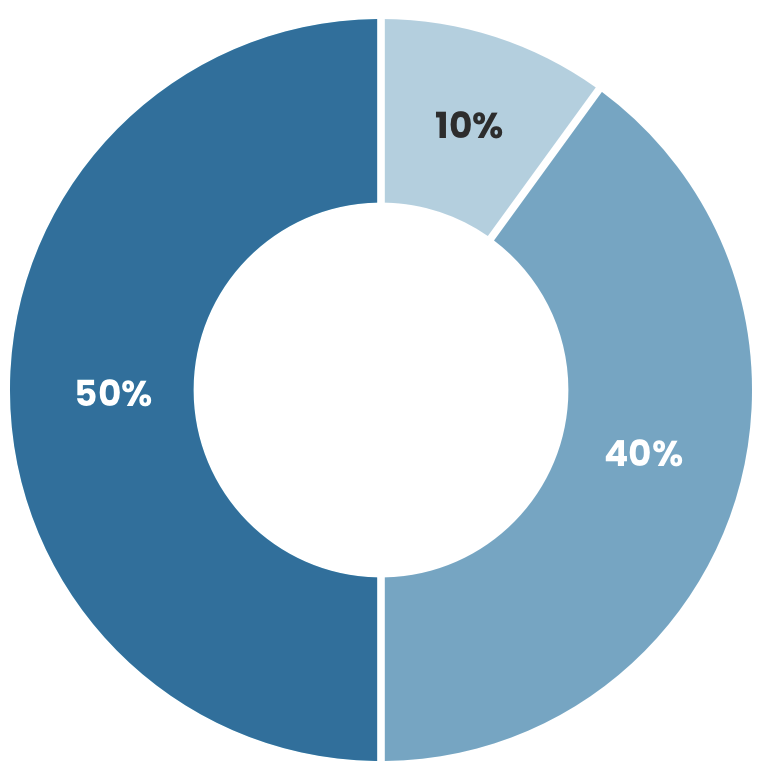

The typical SBA 504 Loan structure is as follows: 50% lenders note, 40% SBA 504 note and 10% borrower contribution.

- Lender (50%)

- CDC / SBA 504 (40%)

- Borrower Contribution (10%)

Current Rates

25-year debentures 25-year debentures Tooltip

20-year debentures 20-year debentures Tooltip

Benefits of the SBA 504 Loan

Positioning Businesses for Growth

Why the SBA 504 Loan is Right for You

SBA 504 Loan Eligibility Requirements

- Most for-profit, owner-occupied small businesses in the U.S.

- Tangible Net worth less than $20 million

- Net profit is no more than $6.5 million

2-year average after tax (including affiliates) - Manufacturers

With 500 or less employees (including affiliates)

Capital CDC Borrower

Meanwhile Brewing

Austin, Texas

SBA 504 Loan Programs

Commercial Real Estate & Equipment Loan

Providing up to 90% financing for commercial property and equipment purchases.

- For-profit, owner-occupied small businesses in U.S.

- Tangible net worth less than $20 million

- Net profit after tax (2-year average) of no more than $6.5 million (including affiliates)

Refinancing

Co-Lender financing designed to refinance existing commercial real estate or equipment debt.

- For-profit, owner-occupied small businesses in the U.S.

- Businesses with at least two years of operations and whose debt is at least 6 months old (projects without expansion only).

- Business must occupy at least 51% of its property at the time of application

Green Energy Program

Secure up to $5.5 million for projects that meet SBA's green energy standards and meet one of the following goals to qualify:

- Reduce energy use by 10%

- Renewable energy sources that generate at least 15% of the energy used

- Increased use of sustainable designs

- Most energy improvements & equipment can be rolled into the loan

Find Your Loan Officer Today!

Feel confident knowing we are the leading non-profit provider of small business financing. Our Loan Officers are experts and have been helping people fund their dreams since 1993.

See Our Loan OfficersFrequently Asked Questions

Small Business Success Stories

Picoso's Mexican Kitchen Opens New Restaurant in Lubbock with SBA 504 Financing

Picoso's Mexican Kitchen | Lubbock, Texas

AEND Industries Uses SBA 504 Loan to Relocate to Texas

AEND Industries | Hutto, Texas

Brewing Up Small Business Success

Deep Ellum Brewing Company | Dallas, Texas

T-Top Manufacturing Expands Operations into Bridgeport, Texas

T-Top Manufacturing | Bridgeport, Texas

Nitro Swimming Makes Waves in the Austin Area With Second Location

Nitro Swimming | Bee Cave, Texas