Getting Started

A variety of small business loans for every entrepreneurs' needs.

Our Loans

We are with you Every Step of the Way

Connect with our expert Loan Officers, providing basic financial information.

24 – 72 HRS

Work with our Loan Officers to gather all the documents needed for your loan.

Weeks 1 – 2

Loan Officers will prepare the documents and submit them to the Small Business Administration for approval.

Weeks 2 – 4

Work with our dedicated team to finalize any documents and receive funding.

Weeks 4 – 6

Eligible Use of SBA 504 Funds

Small Business Success Stories

Picoso's Mexican Kitchen Opens New Restaurant in Lubbock with SBA 504 Financing

Picoso's Mexican Kitchen | Lubbock, Texas

T-Top Manufacturing Expands Operations into Bridgeport, Texas

T-Top Manufacturing | Bridgeport, Texas

AEND Industries Uses SBA 504 Loan to Relocate to Texas

AAEND Industries | Hutto, Texas

Brewing Up Small Business Success

Deep Ellum Brewing Company | Dallas, Texas

Nitro Swimming Makes Waves in the Austin Area With Second Location

Nitro Swimming | Bee Cave, Texas

Picoso's Mexican Kitchen Opens New Restaurant in Lubbock with SBA 504 Financing

T-Top Manufacturing Expands Operations into Bridgeport, Texas

AEND Industries Uses SBA 504 Loan to Relocate to Texas

Brewing Up Small Business Success

Nitro Swimming Makes Waves in the Austin Area With Second Location

Items you may need to provide

As a new business borrower, you may need these items:

Existing Businesses should also provide:

“As a commercial lender in northern New Mexico, I have been using Capital CDC as a source for SBA 504 financing for many years. I have a high degree of confidence in referring our Bank's clients to Capital CDC, as I know their requests will be worked on with the highest level of professionalism and care. I look forward to working with Capital CDC for many more years to come.”

Tony Ornelas, Enterprise Bank

Find Your Loan Officer Today!

Feel confident knowing we are the leading non-profit provider of small business financing. Our Loan Officers are experts and have been helping people fund their dreams since 1993.

See Our Loan Officers

VetLoan Advantage Program

Eligible veteran-owned businesses seeking SBA 504 financing can take advantage of the VetLoan Advantage program that allows Capital CDC to rebate a portion of the processing fee.

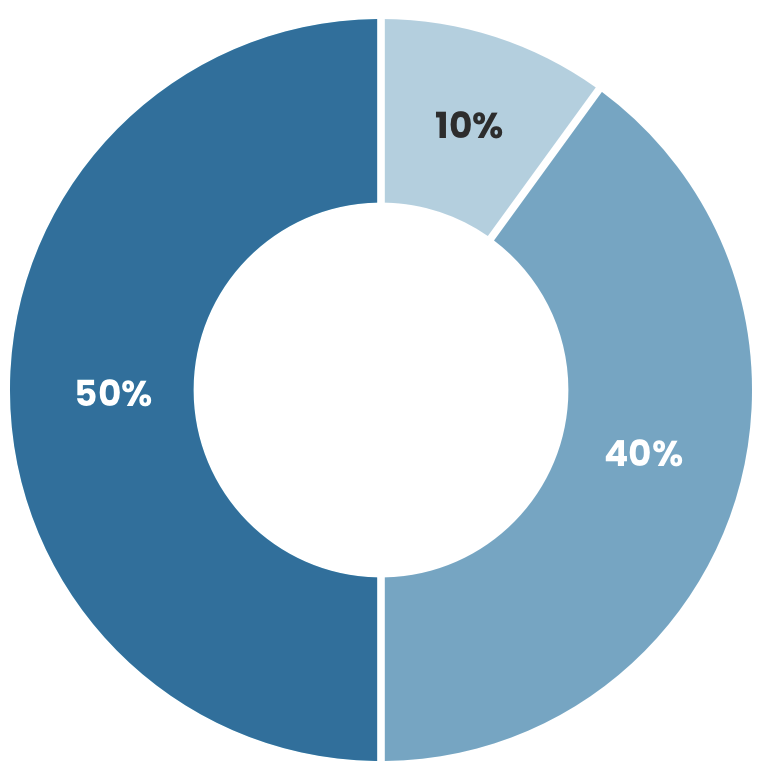

Download the Insider's GuideFinancing Structure

The typical SBA 504 Loan structure is as follows: 50% lender's note, 40% SBA 504 note and 10% borrower contribution.

- Lender (50%)

- CDC / SBA 504 (40%)

- Borrower Contribution (10%)

Current Rates

25-year debentures 25-year debentures Tooltip

20-year debentures 20-year debentures Tooltip