Our Loans

“Capital CDC did a really nice job of making the process easy for us. They took a lot of the legwork and the grunt work out of our hands and handled a lot of it themselves. The loan process was quick and took us a much shorter timeframe to open.”

Mike Koleber, Nitro Swim

Find Your Loan Officer Today!

Feel confident knowing we are the leading non-profit provider of small business financing. Our Loan Officers are experts and have been helping people fund their dreams since 1993.

See Our Loan OfficersFinancing Structure

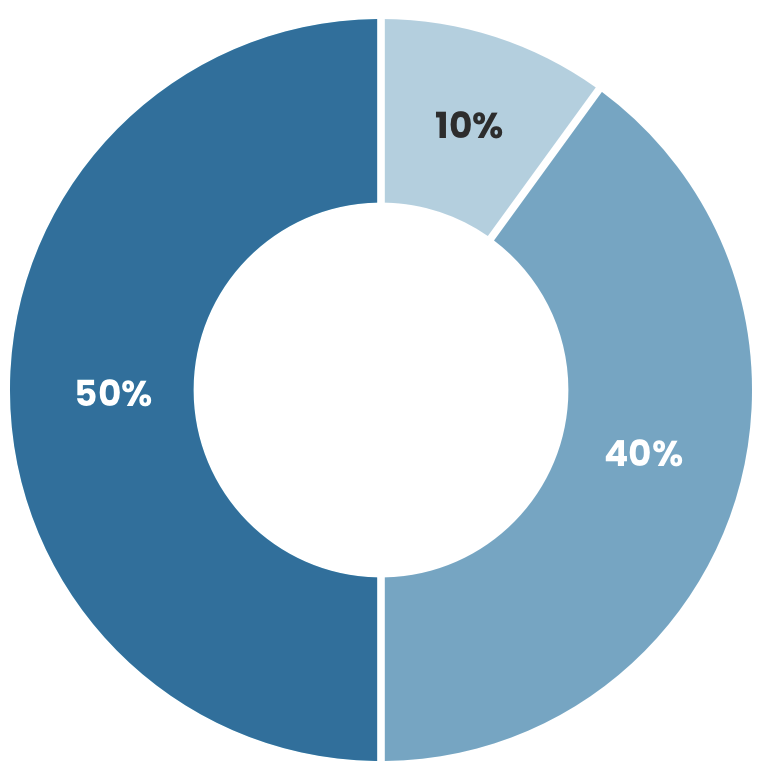

The typical SBA 504 Loan structure is as follows: 50% lender's note, 40% SBA 504 note and 10% borrower contribution.

- Lender (50%)

- CDC / SBA 504 (40%)

- Borrower Contribution (10%)

Current Rates

25-year debentures 25-year debentures Tooltip

20-year debentures 20-year debentures Tooltip

Frequently Asked Questions

Small Business Success Stories

Our recognized success shows our continued dedication to constant improvement and growth.

T-Top Manufacturing Expands Operations into Bridgeport, Texas

T-Top Manufacturing | Bridgeport, Texas

AEND Industries Uses SBA 504 Loan to Relocate to Texas

AEND Industries | Hutto, Texas

Nitro Swimming Makes Waves in the Austin Area With Second Location

Nitro Swimming | Bee Cave, Texas

Brewing Up Small Business Success

Deep Ellum Brewing Company | Dallas, Texas

Picoso's Mexican Kitchen Opens New Restaurant in Lubbock with SBA 504 Financing

Picoso's Mexican Kitchen | Lubbock, Texas